- Dear Daughter

- Posts

- Dear Daughter (X)

Dear Daughter (X)

Paris, investing and research

Dear Daughter (X),

I hope you enjoy your first day in Paris! I´m so excited for you, and I miss you a little bit already. Please remember that croissants are full of unhealthy fat.

The other day, you asked me about investing in stock. My answers were so and so, but it got me thinking. Here is all I know about the stock market in 100 seconds:

You have to appear stupid to make a lot of money on individual stocks, If your strategy is not luck, you need to believe something few others believe in. You need to either know that a stock is very undervalued or overvalued and that you get something few others understand (if they understood it, the stock would be as valuable as you believe it to be - and no advantage to you.) To appear stupid for having very different views and putting money behind it is very, very difficult to do. When everyone believes in AI, and companies in that space are doing great, and you, because of your theory, believe the opposite, you must accept looking like an idiot, maybe for a long time. To really get this point, read the book or watch the movie “The Big Short.”

A share/stock is ownership to a company and its future free cash flow (the money it can return to its owners)

In the stock market, sellers and buyers continuously meet at the stock price. The Sellers believe the stock price will go down, while the buyers believe it will increase. Whenever you are buying a stock, take a second to consider why someone will sell it to you.

A speculator buys stocks because she believes someone else will buy them at a higher price, and an investor buys a stock because she believes the future free cash flows will increase more than others believe. To rephrase an important quote – “in the short run, the stock market is a voting machine.” this means that every minute of every day, people from all over the world vote on the price. Their voting may, at times, be irrational and not reflect how the company is actually doing. “…but in the long term, the stock market is a weighing machine” where the real value will be visible and priced fairly.

It is very difficult to make money in the stock market above the average return (the index). Most who do it are lucky. Only a very, very small group (maybe a few hundred globally) can do it over time.

There are only 2 ways to make money investing – either the stock price goes up, or the company pays out dividends to their stock owners.

Great companies are normally valued at a high price, shitty companies at a low price. So, buying a great company is not a sure way to make money since its greatness is already reflected in its price.

The price of a stock does not say anything about a company. A 100 USD stock is not cheaper than a 1,000 USD stock (if there are a billion stocks in a company and they are selling for 100 USD, it is worth more than a company with 1,000 shares costing 1,000 USD).

Very few people who give stock advice and advice on money allocation have made money above the index from it.

Dogfooding—You might gain an advantage in the products and services you use and love. Being young and at “the cutting edge " might mean you can discover things early. Check if there is an opportunity to invest in these things and the companies behind them if they are priced fairly. This is often called dogfooding - eating your own dog food.

Now back to business

We have started to do research. From my good old consulting days, we called it desktop research. Sitting at your desk trying to find data, websites, articles, and research papers. I remember a project we did for a large Telekom operator to analyze all the Middle East and North Africa markets for investment opportunities. Data was challenging to find, and we had to say something about the size of the middle class in these countries 20 years ago. We triangulated (data from different sources), and I remember using the number of ATMs as a proxy (alternative data points you believe are correlated to what you are looking for) for the middle class in different countries. In real life, you don´t have all the data, and you often need to make assumptions and come up with proxies.

It is often very tempting to sit behind your computer to do the research but to make quick progress; you need to pick up the phone and talk to experts. We talk to professors at NTNU, Oslo Met, scent experts from perfumeries, and many global producers of aroma oils. We know we need 7 different scents and find a way to store and release the aroma. The aroma should be long-lasting, so the customer does not have to refill it too often. We quickly find different alternatives to store and release the aroma:

We can use aroma oil - This well-established technology will probably work, but it has a significant drawback. Shipping may be complicated since it is considered highly flammable.

We can use perfumes - Another alternative we should consider is using perfumes, but I´m not sure how easy it will be to work with fluids.

We can use wax. Wax soaked in aroma oils could be an alternative, and it is already used for millions of scented candles. A challenge will be to heat up and release enough scent.

We can use felt - I have seen several felt pads that look good and could be scented with oils or perfume. The main challenge would probably be making it long-lasting.

Other solutions – Maybe there is a mix of solutions or some that we have not considered.

Then, we have the challenge of releasing the scent. From the research, we find a few different ways:

No mechanism – We just open a chamber up, and the scent would be strong enough to evaporate naturally.

Vibrations – Some scent diffusers use tiny but very rapid vibrations to release the scent molecules.

Fan – A fan to either suck or push the aroma out will speed up the release of the scent.

Heat – Heating the aroma might start a reaction to release more scent.

Ok, here are the first fuckups that cost us a lot of time. Doing a new product is never a straight line.

Our first hypothesis was to mix aroma oil with some compound to encapsulate the scent at room temperature and release it when heated. In other words, we thought we could solve it with chemistry. I probably read 50 papers on the subject and worked with professors and lab engineers to test the hypotheses. We also did some of our own experiments and some showed promise. But eventually, we found that it was too difficult, the solutions were too unstable, and it was not ideal to bring a heating element into the product (next to your bed). Going down this path, probably cost us 3 weeks.

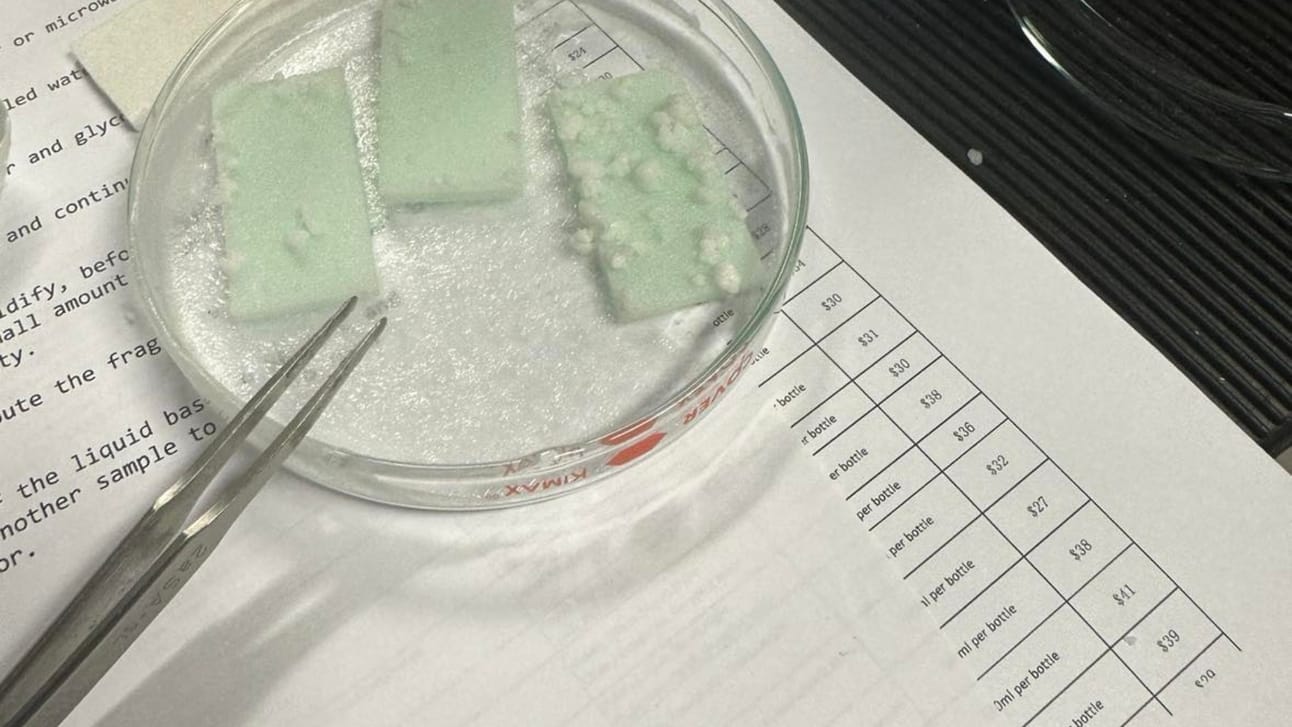

The next theory was to use felt pads and soak them in aroma oil. This gave off a strong scent, but over a period of two weeks, the scent wore off, and we had to back away from that solution. This probably cost us two weeks.

In the following letter, I´ll share what we landed on, which is amazing.

Weeks are essential here, as I am trying to have the Night Booster ready for Christmas. Of course, this product will sell all year round, but everything sells better at Christmas. Every week of delay makes Christmas less likely. To combat delays, the first line of attack is transport. Shipping the Night Booster over the sea by container takes 5-6 weeks, compared to flying it in, which is much more expensive but only takes 1 week. The next approach to save time is to reduce the number of prototypes or approve prototypes by video meetings instead of waiting 5 days to have the product arrive by courier. Then if we are still a few weeks short, we move into scary territory that I want to avoid, which is to gamble that things will work out and to have the producer work in parallel on the different tasks instead of waiting for the results of tests, etc. No matter what, there will be exciting times ahead.

With all the love and support,

Dad

P. S June, whenever you get a job, remember you work with and not for anybody. You want to be a valuable partner, not a passive servant. If you have this mentality, you will get far.

P.P.S. Here´s a hack that will impress in business. How long will it take to double your money for a given return/interest rate? You just apply the rule of 72. Take 72 and divide it by the interest rate, and you get the number of years. Let´s start with the simple case, 10%. You do 72/10 and get 7,2 years. If the return you get is 5%, you do 72/5, and you get 14,4. Since you are a math whiz, you see that you can also answer the question, “If you have to double the money in 5 years, what rate of return do you need?” The answer is 72/5= 14,4%.